Market Analysis ’18 & Price Forecasts ‘19

2018-12-11

At the season’s greetings, PRAUDEN offers merchandisers of down and feather products the invaluable information that includes this year’s market analysis and forecasts of the next year’s prices, as well as what to keep in mind to fare as well as you’ve been.

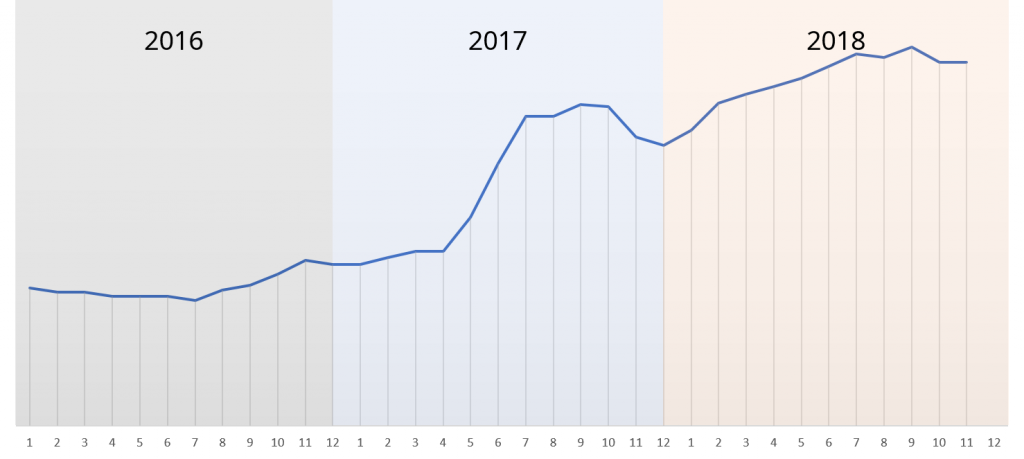

Annual Price Trends

<3-year Down and Feather Price Trend since ‘16>

From January to March: Fluctuating down and feathers price settled at the end of 2017 for reasonable price level, influencing the makers’ decisions to produce more cloths and beddings for FW seasons. ‘Diehard’ environmental policies from the world’s largest raw materials exporter China, however, gave rise to sudden price hike. See more

From April to June: Supply failed to catch up to demand as prices went up. Price hike led some unprepared down suppliers terminate their supply contracts with the brands due to inability to procure down and feathers at contracted prices.

From July onward: July caps the annual supply of down and feathers for clothes, where price goes down for most of the time due to extensive hiatus in massive demand. For this year, however, some global name brands decided to buy down and feathers earlier for FW19 on mid-September, price went up since.

What has happened to Down and Feathers Market ‘18

1. Price Hike

Supply failed to catch up to demand due to policy-bound decline in supply, when demands from global fashion brands were retained with stability. Price has been up all throughout the year in this connection. As of the end of November, price of raw materials is up by 30% or 120% compared to that of early this year or early previous year, respectively.

2. Fake Down in Market

Price hike in raw materials led fake downs distributed to the market, victimizing consumers. Both IDFB and down and feather suppliers like PRAUDEN work in close company with testing agencies to crack down fake down and throw those fake down distributors out of the market; consumers are victimized still. Beware and pay special attention to this. For more information, visit here.

3. Vulnerable Vendors Terminating Supply Contract in the Middle due to Price Hike

Some down suppliers which did not have sufficient down and feathers in stock voluntarily terminated their supply contract with fashion brands due to price hike.

Price Forecasts ‘19

– Shortage in Raw Materials: Strict environmental policies have been declared from China, the world’s largest raw materials exporter; stronger environmental compliances must be secured by the corporate farms restructured to meet the compliances or shut their businesses in the rural farmlands where small and medium corporate farms fail to meet those strict criteria. Already happened this year is ducks and geese are hardly found in rural farmlands, leading to constant decrease in raw materials supply for a while.

<China’s War Against Pollution>

Source: CHINA BRIEFING

– Demand Remains Constant: With the clothing industry expecting bullish FW market just like the previous year, it is expected that a number of global name brands will increase production despite high raw materials price. Since name brands dare not to opt to chemical fibers, demand for down and feathers will remain high.

Raw materials price will also remain high with supply and demand imbalance as global name brands’ demand for raw materials were already determined at the end of the previous year, where fluctuating market conditions won’t affect the price of raw materials. Growing demands for raw materials from the Chinese local brands will add fuel to the fire.

PRAUDEN Suggests

Competition is fierce among down suppliers since more companies jumped into the market. Since the greatest part of down price accounts for the price of raw materials, the price of down trends similar, upward or downward, to that of raw materials. In this connection, special attention is required to raw materials offered at unusually discounted price.

Price hike in the raw materials this year was more unusual than any other time, not to mention significant decrease in supply, leading to sudden termination of supply contracts by some unprepared raw material suppliers and significant damages to the industry. With this year’s trends of supply and demand expected to last, special attention is required to prevent such damages; contracts need concluded with preventive clauses, inspection of bulk supplies need done more strictly, and financially stable suppliers of raw materials need chosen.

To represent stable supply of down and feathers at reasonable prices, PRAUDEN reserves various procurement strategies by term and item, assisting the buyers in deciding when to purchase down and feathers by providing valuable, in-depth information as available from the industry.

By Lee Mi-ra, Sourcing Part, PRAUDEN