How Long Will the Raw Material Price of Down Remain This High?

2017-08-03

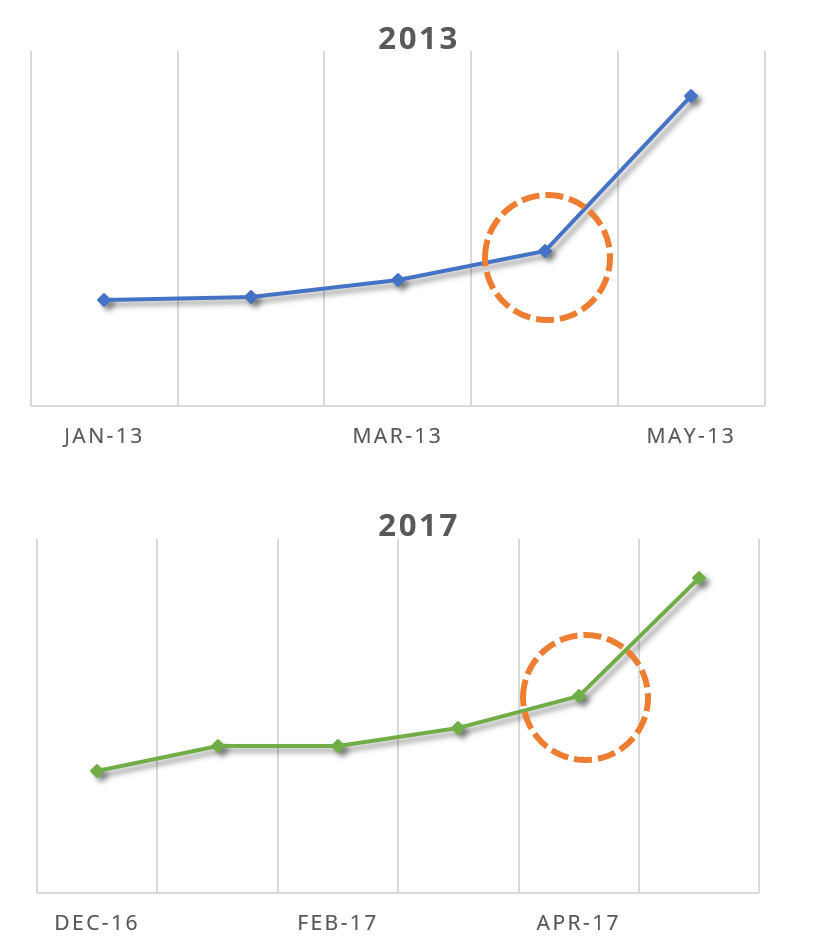

The price of raw materials of down is generally flexible, repeatedly fluctuating within a range of 10% depending on supply and demand. However, the recent change in the price of raw materials of down seems to deviate from this tendency. The price of the raw materials skyrocketed by about 20% from early May and about 45% from early January. This pattern is similar to that of May 2013, when a down crisis took hold. As many down sellers predict that the price of down will continue to soar, the chaos caused by the heightened prices is unavoidable for the time being. This article looks into the causes of this price spike, and presents the countermeasures of PRAUDEN to get through this situation.

Enforcement of a Strict Environmental Protection Law in China

Since January 1, 2015, the New Environmental Protection Law has been enforced in China. For the protection of the environment, the Chinese government has placed stricter regulations than ever before on the whole industry (see KOTRA). To monitor the compliance with these regulations, the central government is carrying out a nationwide environmental protection inspection, and the intensity of crackdowns against regulation violations is also unprecedented. As this period of strong scrutiny and crackdown continues, many companies have faced strict administrative penalties, including outright business suspension (see KOTRA).

Strong Reinforcement of Environmental Regulations on Pollution Caused by Livestock Raising Directly Impacts the Price of Down

Livestock farms are subject to environmental regulations. Especially in the 2000s, the livestock industry in China has rapidly evolved, and the number of livestock has increased at an exponential rate. This led to the rise in the amount of livestock wastes (manure, wastewater, odor, etc.), which have been blamed for causing water pollution and infectious diseases. To solve this problem, the Chinese government has carried out reinforced inspections for nationwide environmental protection regarding pollution caused by livestock farming since early this year, and strict restrictions have been imposed on livestock breeding throughout China.

Duck and goose ranches are also subject to regulation as livestock farms. In Fujian Province, one of the major distributing centers of gray goose down, 14 duck ranches have been demolished in Liming Village by the district’s urban construction department. It also warned other duck and poultry farms to move to another area within five days. In Jiangsu Province, measures are being taken to prevent water pollution and restrictions are imposed on the number of livestock, and the shutdown or relocation of livestock farms that do not meet environmental requirements are aggressively pushed forward.

While environmental regulations such as forced reduction of the number of livestock, mandatory construction of waste disposal facilities, notification of the demolition of farms within areas designated for environmental protection within 30 days are being strictly enforced, the national level support or compensation is not properly provided for these farms. This makes most duck and goose farmers decide to close their farms or reduce the size of breeding populations. This trend has directly affected the production of down and China is currently experiencing a crisis in the supply and demand for down to the extent that some say “there is supposedly pricing but no real trade activity of down.” Even before the aftermath of the previous avian flu crisis has set in, the production of down has dropped due to these environmental regulations, which seemingly led to such a sharp rise in down prices.

<A TV report about the reinforcement of environmental restrictions on the pollution

caused by livestock breeding in Jiangsu Province, China.>

Image source: JSTV

What is PRAUDEN’s future price outlook?

The price of raw materials of down is volatile and difficult to predict. Particularly, in 2017, the price has exhibited an unusual pattern of changes, rising for several consecutive months due to the imbalance of supply and demand and skyrocketing by up to 50%. Nonetheless, PRAUDEN predicts that the rise in down prices will continue until the third quarter and then gradually begin to slow down from the fourth quarter. Until the third quarter, there will be a short supply of down due to the environmental restrictions on livestock breeding and the aftermath of the avian flu crisis in China, while the level of trade and demand of down are expected to surge. However, it is unlikely that the price will continue to rise if trading volume shrinks and the breeding environment and the supply of down regain stability in the fourth quarter.

<Comparison of down price trends in 2013 and 2015: The price trends in the periods of January to May 2013 and December 2016 to May 2017 show a similar pattern.>

PRAUDEN has already secured the supply of down for major sales items in accordance with its policy of safe inventory management. The safe inventory policy is a system that maintains an appropriate level of inventory in a timely manner by analyzing the five-year volume movement cycle for major sales items. However, there is a possibility that some down suppliers in China, which unilaterally change the terms of trade depending on the down market situation, may default on contracts. As in the domestic market, the price of down for most of the trade volume is determined at a certain time of the year, a big loss may occur if contract prices are changed by the suppliers of the raw materials of down. As a means to address this, PRAUDEN has been striving to secure a stable supply by storing as much raw materials as possible in additionally leased warehouses as well as the warehouse in Nanjing. In addition, PRAUDEN will continue to keep tabs on market trends as there are still a number of underlying variables that may affect changes in down prices.

By PRAUDEN Sourcing Part, Kim Jeong-mi/Go Min-jeong