When Is the Best Time to Buy Down?

2020-09-02

As a natural material, down comes with a higher price tag compared to mass-produced synthetic fibers. The down prices influence finished products’ retail prices, which are a determinant of the sales volume and margin. That is the reason why the annual down prices are a matter of common interest for merchandisers.

Down prices are highly volatile. At its peak, it would cost triple the price compared to the troughs. What makes this material so volatile?

A commodity’s price is determined by its demands and supply. Down supply features high volatility, which is due to: first, down is a byproduct from the food industry, meaning that increases in demands do not justify increases in supply. Second, the supply is exposed to environmental impacts that are out of human control, for example avian influenza and natural disasters. Third, 80% of the global supply rely on Chinese producers, hence prone to changes in China’s national policy, environment, or economy.

This article presents an analysis of down price changes in the last decade and their causes as reference data for down purchase decisions.

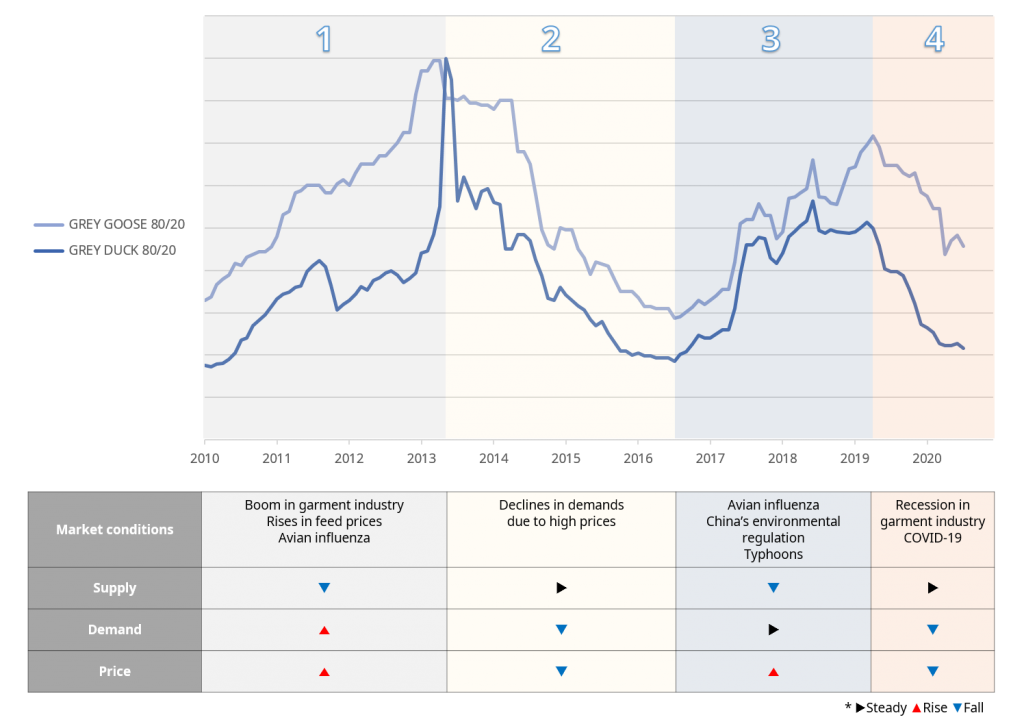

Down price changes between 2010 and 2020

<Down price changes between 2010 and 2020>

1. 2010-2013: Upturns

A boom in the garment industry led to increases in down demands. However, feed price rises in China resulted in decreases in duck and goose breeders, and the slump in supply caused by the 2013 avian influenza outbreak made the down price reach its peak in the decade.

2. 2014-2016: Downturns

Supply became back to normal when avian influenza got unruffled. High down prices led to less down prices planned, hence declines in demands and price falls.

3. 2017-2019: Upturns

As China enforced regulations under the new “Environmental Protection Law,” farms that found themselves unable to meet the state requirements closed down or downscaled, hence declines in down supply. (See: How Long Will the Raw Material Price of Down Remain This High?)

In 2018, typhoons in autumn struck some duck farms, leading to further declines in supply, which in turn led to price hikes.

In the second half of 2018, goose down price rises outtopped duck down and the gap has remained so far. The growth of the Chinese economy meant Chinese customers’ stronger buying power, which supposedly made them prefer goose down over duck, hence increases in demands.

4. 2020-Present: Downturns

Down supply remains steady as farms have finished facility revamping. However, COVID-19 struck the global economy, and the garment industry was no exception. Unsure about sales, brands have made drastic cuts in product plans, which has led to massive falls in down demands. The down prices went down by 30-40% in the first half of 2020.

Recommended purchase strategy

When down prices are steady or expected to go down, buying on scale while keeping an eye on price changes is the way to minimize loss when the price goes further down or risk for potential rebound. If the market environment changes towards becoming bullish, it would be a good strategy to procure at least 50% of the amount needed and then find out how the wind blows. It would help spread out the risk for further price rises, and even if the price falls, avoid loss for the entire volume purchased.

Future market prospect

The data in the last decade show the factors that influence down prices following the law of supply and demand. To make the best decision on when to buy down, first collect relevant intelligence from various sources, validate their accuracy, and predict how the price would change following the law of supply and demand.

At present, no significant changes in supply and demand are envisaged, implying that the price would remain steady until the end of this year, or if longer, through to the first half of the following year. However, this should not be considered the final call. There always exists risk for instability in supply. A good move to avoid the risk in the long run would be to carry on deals with suppliers that have an adequate amount of down in stock.

By Lee Mi-ra, PRAUDEN Sourcing Part